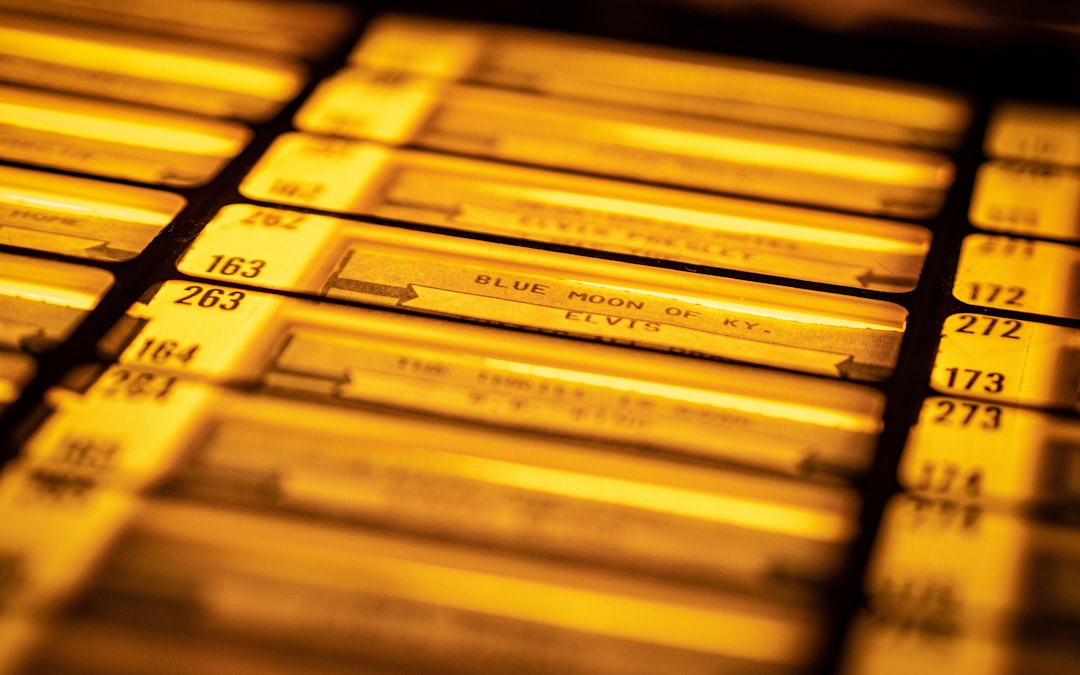

Executive Order 6102, signed by President Franklin D. Roosevelt on April 5, 1933, marked a pivotal moment in American history, particularly in the context of the Great Depression. This order mandated the confiscation of gold coins, gold bullion, and gold certificates from American citizens, compelling them to surrender their holdings to the government in exchange for paper currency.

The rationale behind this drastic measure was to combat the economic turmoil of the time, as the nation faced rampant inflation and a banking crisis that threatened the very fabric of the economy. By removing gold from circulation, the government aimed to stabilize the financial system and restore public confidence in the dollar. As you delve deeper into the implications of Executive Order 6102, it becomes clear that this action was not merely a financial maneuver but a reflection of the broader struggles faced by the American populace during the 1930s.

The order was part of a series of New Deal policies designed to address the economic devastation wrought by the Great Depression.

The implications of this order would resonate for decades, shaping both economic policy and public sentiment toward government intervention in financial matters.

Key Takeaways

- Executive Order 6102 was issued by President Franklin D. Roosevelt in 1933, requiring all individuals and entities to turn in their gold coins, bullion, and certificates to the Federal Reserve in exchange for paper currency.

- The historical context of gold confiscation dates back to ancient times, with various governments using it as a means to control currency and stabilize their economies.

- The effects on the economy were mixed, with some arguing that it helped stabilize the economy during the Great Depression, while others believe it led to increased government control and manipulation of the currency.

- The impact on individual citizens was significant, as many felt their personal property rights were violated and their financial security was compromised.

- The legal and ethical implications of Executive Order 6102 sparked debates about government overreach and the infringement of individual rights, leading to long-term consequences and lessons learned.

Historical context of gold confiscation

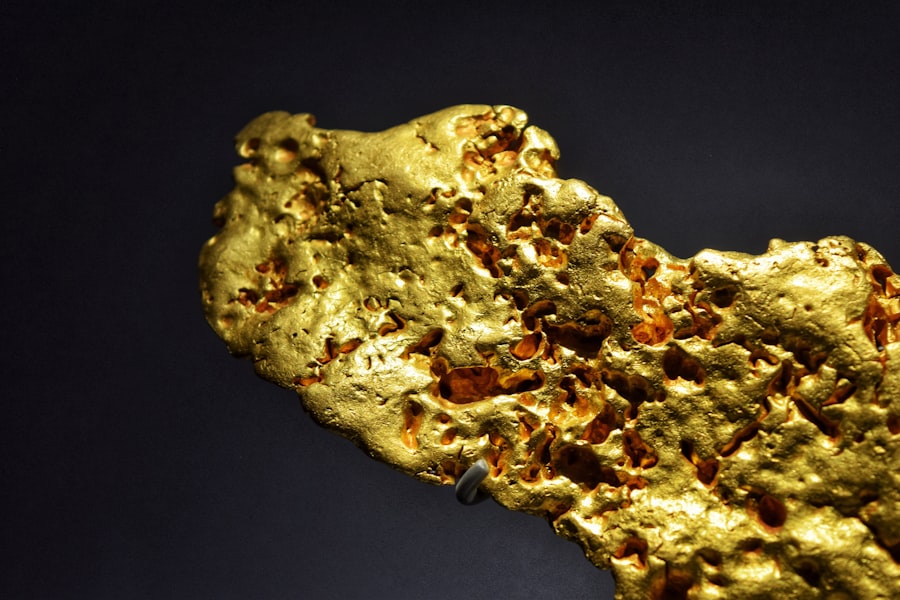

To fully understand Executive Order 6102, it is essential to consider the historical context surrounding its issuance. The Great Depression, which began with the stock market crash of 1929, led to widespread unemployment, bank failures, and a general loss of faith in financial institutions. As people scrambled to protect their wealth, many turned to gold as a safe haven.

This surge in gold hoarding exacerbated the economic crisis, leading to a depletion of gold reserves and further destabilizing the banking system. In response to this crisis, Roosevelt’s administration sought to implement measures that would restore liquidity to banks and encourage spending. The decision to confiscate gold was rooted in the belief that by limiting private ownership of gold, the government could increase the money supply and stimulate economic activity.

This historical backdrop highlights not only the desperation of the times but also the lengths to which the government was willing to go to regain control over the economy. The confiscation of gold was seen as a necessary evil in an era defined by uncertainty and fear.

Effects on the economy

The immediate effects of Executive Order 6102 on the economy were profound and multifaceted. By forcing citizens to exchange their gold for paper currency, the government effectively increased the money supply, which was crucial for stimulating economic activity during a time of severe deflation. This influx of currency into circulation helped to stabilize prices and restore some level of confidence among consumers and businesses alike.

As banks regained access to gold reserves, they were better positioned to lend money, which further fueled economic growth. However, while these measures provided short-term relief, they also had long-lasting implications for monetary policy in the United States. The abandonment of the gold standard allowed for greater flexibility in managing the economy but also raised concerns about inflation and currency devaluation.

As you reflect on these effects, it becomes evident that Executive Order 6102 was not just a response to an immediate crisis; it fundamentally altered the relationship between citizens and their government regarding economic control and monetary policy.

Impact on individual citizens

| Category | Metrics |

|---|---|

| Health | Access to healthcare, life expectancy, disease prevalence |

| Education | Literacy rate, school enrollment, access to quality education |

| Employment | Unemployment rate, job opportunities, income levels |

| Quality of Life | Housing, access to clean water, sanitation, safety |

For individual citizens, Executive Order 6102 represented a significant infringement on personal property rights. Many Americans viewed the confiscation of gold as an unjust seizure of their wealth, leading to feelings of resentment and distrust toward the government. Those who had diligently saved their money in gold found themselves compelled to surrender their assets under threat of legal penalties.

This loss was not merely financial; it also struck at the heart of personal autonomy and freedom. The emotional toll on citizens was considerable. For many, gold was not just an investment; it symbolized security and stability during turbulent times.

The government’s actions left individuals feeling vulnerable and exposed, as they were forced to rely on paper currency that could be subject to inflationary pressures. As you consider these impacts, it becomes clear that Executive Order 6102 had far-reaching consequences that extended beyond economics into the realm of personal identity and societal trust.

Legal and ethical implications

The legal ramifications of Executive Order 6102 were complex and contentious. On one hand, Roosevelt’s administration justified the order as a necessary measure to stabilize the economy during a national emergency. The government argued that it had the authority to regulate monetary policy in times of crisis, citing precedents for emergency powers.

However, critics contended that such actions set a dangerous precedent for government overreach and infringed upon individual rights. Ethically, the order raised significant questions about property rights and governmental authority. Many citizens felt that their rights were being violated without due process or adequate compensation for their losses.

The moral implications of forcibly taking private property for public benefit sparked debates that continue to resonate today. As you reflect on these legal and ethical dimensions, it becomes evident that Executive Order 6102 was not merely an economic decision; it was a profound statement about the balance between individual rights and collective responsibility during times of crisis.

International repercussions

The international repercussions of Executive Order 6102 were significant as well. As other nations observed America’s bold move to abandon the gold standard, many began to reconsider their own monetary policies. The global economy was already reeling from the effects of the Great Depression, and Roosevelt’s actions sent shockwaves through international financial markets.

Countries that had previously adhered strictly to gold-backed currencies faced pressure to adapt or risk further economic instability. Moreover, this shift contributed to a broader trend toward currency devaluation as nations sought competitive advantages in international trade. As countries abandoned gold standards in favor of more flexible monetary policies, it became increasingly clear that global economic dynamics were shifting.

You may find it interesting how Executive Order 6102 not only transformed American monetary policy but also played a role in reshaping international economic relations during a critical period in history.

Subsequent government actions

In the years following Executive Order 6102, subsequent government actions reflected an ongoing commitment to managing economic stability through interventionist policies. The abandonment of the gold standard paved the way for more expansive monetary policies, including increased government spending and regulation of financial markets. These measures aimed at preventing future economic crises became hallmarks of American fiscal policy throughout much of the 20th century.

Additionally, Roosevelt’s New Deal programs laid the groundwork for a more active role for government in economic affairs. The establishment of institutions like the Federal Deposit Insurance Corporation (FDIC) and Social Security demonstrated a shift toward safeguarding citizens against economic uncertainties. As you consider these subsequent actions, it becomes clear that Executive Order 6102 was not an isolated event but rather part of a broader transformation in how government approached economic management.

Public response and resistance

The public response to Executive Order 6102 was mixed, with some citizens supporting Roosevelt’s efforts while others vehemently opposed them. Many Americans recognized the dire state of the economy and understood the need for drastic measures; however, others viewed the confiscation of gold as an infringement on their rights and an overreach of governmental power. This division led to protests and organized resistance among those who felt wronged by the government’s actions.

Grassroots movements emerged as individuals sought to reclaim their rights and challenge what they perceived as unjust policies. Some citizens resorted to civil disobedience or underground networks to retain their gold holdings despite legal repercussions. This resistance highlighted a fundamental tension between government authority and individual liberties—a theme that continues to resonate in contemporary discussions about personal freedoms versus state intervention.

Long-term consequences

The long-term consequences of Executive Order 6102 are still felt today in various aspects of American life and policy. The shift away from a gold standard fundamentally altered how monetary policy is conducted in the United States, allowing for greater flexibility but also raising concerns about inflation and fiscal responsibility. The precedent set by this order has influenced subsequent government interventions during economic crises, shaping how policymakers respond to financial instability.

Moreover, public sentiment regarding government intervention has evolved over time as citizens grapple with issues related to personal freedoms and economic security. The legacy of Executive Order 6102 serves as a reminder of how quickly circumstances can change and how governments may respond in times of crisis—an important lesson for future generations navigating similar challenges.

Lessons learned from Executive Order 6102

Reflecting on Executive Order 6102 offers valuable lessons about governance, economics, and individual rights. One key takeaway is the importance of balancing governmental authority with respect for personal freedoms—a delicate equilibrium that is often tested during times of crisis. The order serves as a cautionary tale about how fear can drive drastic measures that may infringe upon civil liberties.

Citizens must remain vigilant about their rights and engage in meaningful dialogue with policymakers to ensure that interventions are justified and equitable. As you consider these lessons, it becomes clear that understanding history is crucial for navigating contemporary challenges effectively.

Relevance to current economic policies

In today’s context, Executive Order 6102 remains relevant as discussions about economic policy continue to evolve amid new challenges such as inflationary pressures and financial instability caused by global events like pandemics or geopolitical tensions. The balance between government intervention and market freedom is still hotly debated among economists and policymakers alike. As you reflect on current economic policies, consider how historical precedents like Executive Order 6102 inform contemporary discussions about monetary policy, fiscal responsibility, and individual rights.

Understanding this historical context can provide valuable insights into how best to navigate today’s complex economic landscape while safeguarding both public welfare and personal freedoms. In conclusion, Executive Order 6102 stands as a significant chapter in American history that encapsulates themes of crisis management, governmental authority, individual rights, and economic policy evolution. Its legacy continues to shape discussions about governance and economics today—reminding us that history is not merely a record of past events but a living narrative that informs our present and future choices.

Executive Order 6102, signed by President Franklin D. Roosevelt in 1933, mandated the confiscation of gold from American citizens to combat the Great Depression’s economic challenges. This controversial move aimed to stabilize the banking system by increasing the federal gold reserves. For a deeper understanding of the historical context and implications of this order, you can explore a related article on the topic by visiting Real Lore and Order. This resource provides insights into the broader economic policies of the era and their lasting impact on the U.S. financial system.

WATCH THIS! The 8 Assets You OWN But the Government CONTROLS (Dollar Collapse Survival)

FAQs

What is Executive Order 6102?

Executive Order 6102 was signed by President Franklin D. Roosevelt on April 5, 1933. It required all persons to deliver all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve in exchange for $20.67 per troy ounce.

Why was Executive Order 6102 implemented?

The order was implemented as a response to the Great Depression and was intended to stabilize the economy by preventing hoarding of gold and encouraging spending and investment.

Was gold confiscation under Executive Order 6102 legal?

Yes, the Supreme Court upheld the constitutionality of Executive Order 6102 in the case of United States v. Jewelry and 11,000 Dollars in Gold.

What were the consequences of Executive Order 6102?

The order effectively nationalized gold and made it illegal for individuals to own most forms of gold. It also led to the devaluation of the US dollar against gold.

Is gold confiscation under Executive Order 6102 still in effect?

No, President Gerald Ford signed a bill in 1974 that legalized private ownership of gold, effectively nullifying Executive Order 6102.