Manufacturing Shift: Companies Flocking to Poland

The manufacturing landscape of Europe is undergoing a significant transformation, with Poland emerging as a prominent hub for industrial investment. This shift, driven by a confluence of economic, geopolitical, and logistical factors, has witnessed a steady migration of companies seeking to optimize their production strategies. Poland, once a burgeoning market, has matured into a vital manufacturing engine, attracting businesses across a spectrum of industries. This article will delve into the multifaceted reasons behind this industrial exodus to Poland, examining the key drivers, the benefits offered, and the implications for both the host nation and the global supply chain. The recent report highlights the impact of [Germany factory closures] on the European economy.

Global manufacturing has long been a dynamic entity, subject to constant ebb and flow. The tides of production have, in recent decades, seen significant currents pull industries towards cost-effective locations, often in Asia. However, the predictability of these currents has been disrupted by a series of interconnected forces, prompting a re-evaluation of established supply chain models.

The Rise of Nearshoring and Reshoring

The concept of bringing production closer to end markets has gained considerable traction. Nearshoring, the practice of relocating manufacturing to neighboring countries, and reshoring, bringing production back to the home country, have become strategic imperatives for many businesses. This is not a sudden storm, but rather a gradual recalibration of compasses, steering away from distant shores.

Mitigating Supply Chain Vulnerabilities

The COVID-19 pandemic acted as a stark wake-up call, exposing the fragility of highly globalized and geographically dispersed supply chains. Bottlenecks, port congestion, and disruptions in the flow of goods highlighted the inherent risks associated with relying on distant manufacturing bases. Companies are now prioritizing resilience and agility, seeking locations that offer greater control and predictability over their production and distribution networks. This mirrors the wisdom of not putting all your eggs in one distant basket.

Reducing Lead Times and Transportation Costs

Shorter supply chains translate directly into reduced lead times, enabling businesses to respond more quickly to market demands and reduce inventory holding costs. Furthermore, the escalating costs of international shipping, coupled with increased carbon taxes and environmental regulations, are making proximity to key markets a more significant economic factor. This is akin to understanding that every mile saved in transport is a penny earned in profit.

The Geopolitical Thermometer and its Impact

Geopolitical uncertainties and trade tensions have also played a pivotal role in reshaping manufacturing decisions. The increasing instability in various global regions has led companies to diversify their manufacturing footprint and reduce their exposure to potential conflicts or political upheaval.

Diversification as a Risk Management Strategy

Establishing manufacturing facilities in politically stable regions, like Poland, serves as a crucial risk mitigation strategy. Companies are no longer solely driven by the lowest labor costs but are increasingly factoring in political stability and security of operations. This is akin to planting seeds in different fields to ensure a harvest even if one field experiences drought.

Navigating Trade Agreements and Tariffs

The complexities of international trade agreements, tariffs, and protectionist policies can significantly impact the cost-effectiveness of manufacturing in certain regions. Poland, as a member of the European Union, benefits from a stable trade environment within the bloc and preferential trade agreements with many other countries. This provides a predictable framework for businesses operating within the EU single market.

As manufacturing continues to shift towards Eastern Europe, Poland has emerged as a key player in attracting foreign investment. A related article discusses the various factors contributing to this trend, including Poland’s skilled workforce, competitive labor costs, and favorable business environment. For more insights on this topic, you can read the article here: Manufacturing Trends in Poland.

Poland’s Allure: A Multifaceted Business Ecosystem

Poland has steadily cultivated an environment conducive to foreign investment, building a robust industrial ecosystem that offers a compelling proposition for manufacturers. Its strategic location, skilled workforce, and supportive government policies have created a fertile ground for growth.

Strategic Geographical Advantage

Nestled at the crossroads of Eastern and Western Europe, Poland’s geographical position offers significant logistical advantages. Its well-developed infrastructure, including a network of highways, railways, and proximity to major European ports, facilitates efficient movement of goods within the continent and beyond.

Gateway to European Markets

Poland serves as a gateway to the vast and affluent European Union market. Companies establishing manufacturing operations in Poland gain seamless access to over 450 million consumers, with the added benefit of reduced customs duties and simplified regulatory compliance within the Schengen Area. This position is comparable to a well-placed bridge connecting manufacturing to a massive consumer base.

Connectivity to Eastern and Western Europe

The country’s location facilitates efficient connectivity to both Eastern and Western European markets. This dual access allows companies to cater to a wider customer base and optimize their distribution networks across a diverse range of economies.

A Skilled and Adaptable Workforce

Poland boasts a large and increasingly skilled workforce, a key asset for the manufacturing sector. The country has a strong tradition of technical education and a growing pool of university graduates with expertise in engineering, technology, and specialized manufacturing processes.

Growing Pool of Qualified Professionals

Investment in education and vocational training has led to a steady increase in the availability of qualified engineers, technicians, and skilled laborers. This skilled workforce is crucial for industries requiring precision manufacturing, automation, and advanced technological applications. The readily available talent pool acts as an inexhaustible wellspring for industrial operations.

Competitive Labor Costs

While labor costs in Poland have been rising, they remain competitive when compared to Western European nations. This provides an attractive balance between the cost of human capital and the quality of skills available, a sweet spot for many manufacturing ventures. This is not about exploiting cheap labor, but rather finding an optimal equilibrium between investment in people and operational efficiency.

Government Support and Investment Incentives

The Polish government has actively sought to attract foreign direct investment (FDI) through a range of supportive policies and incentive programs. Special Economic Zones (SEZs) and Euro-Special Economic Zones (ESEZs) offer tax breaks, grants, and streamlined administrative procedures for companies investing in designated areas.

Special Economic Zones (SEZs)

SEZs have been instrumental in driving industrial development in Poland. These zones are designed to provide a favorable business environment, offering incentives such as corporate income tax exemptions, land subsidies, and simplified permitting processes. This is akin to cultivating a greenhouse that nurtures the growth of businesses with specific benefits.

EU Funding and Regional Development Programs

As a member state of the European Union, Poland benefits from access to EU funding programs aimed at promoting economic development, innovation, and job creation. These funds can further enhance the attractiveness of Poland as a manufacturing destination, supporting investments in infrastructure, research and development, and employee training.

Key Industries Driving the Polish Manufacturing Boom

The influx of manufacturing investment in Poland is not concentrated in a single sector but spans a diverse range of industries, each contributing to the country’s growing industrial prowess.

Automotive Sector: A European Powerhouse

Poland has become a significant player in the European automotive industry, attracting a multitude of automotive manufacturers, component suppliers, and related service providers. The country has carved out a niche in producing a wide array of automotive parts.

Assembly and Component Manufacturing

Numerous international automotive brands have established production facilities or partnered with Polish companies for the manufacturing of vehicle components, from engine parts and electrical systems to interior elements and body panels. This has transformed Poland into a crucial node in the European automotive supply chain.

Growth of the Electric Vehicle (EV) Ecosystem

The burgeoning global demand for electric vehicles is further stimulating investment in Poland’s automotive sector. Companies are increasingly focusing on the production of EV components, battery systems, and related technologies, positioning Poland to capitalize on this transformative trend.

Electronics and Technology: A Rapidly Expanding Frontier

The electronics and technology sector is another area experiencing substantial growth in Poland. Driven by innovation and the demand for advanced technological solutions, companies are establishing production facilities for a variety of electronic goods.

Manufacturing of Consumer Electronics

Poland is emerging as a key manufacturing hub for consumer electronics, including televisions, household appliances, and personal electronic devices. The availability of skilled labor and the country’s integration into European supply networks make it an attractive location for these production lines.

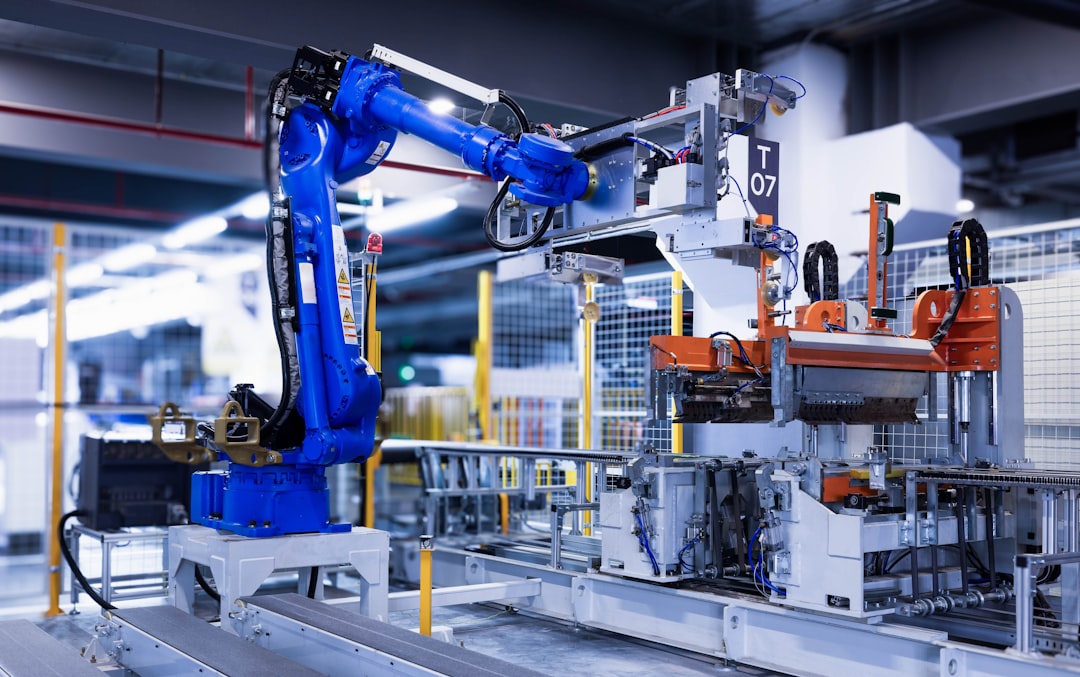

Advanced Technology and Smart Manufacturing

Beyond consumer goods, Poland is also attracting investment in advanced technology manufacturing, including automation solutions, robotics, and smart factory technologies. This reflects a move towards higher-value manufacturing and the adoption of Industry 4.0 principles.

Chemical and Pharmaceutical Industries: Precision and Innovation

The chemical and pharmaceutical industries are also finding a strong foothold in Poland, attracted by the country’s skilled workforce, stringent quality standards, and strategic market access.

Production of Specialty Chemicals

Poland’s chemical sector is increasingly focused on the production of specialty chemicals and intermediate products used in a wide range of industrial applications. This requires a high degree of technical expertise and adherence to rigorous safety and environmental regulations.

Pharmaceutical Manufacturing and Research

The pharmaceutical industry in Poland is experiencing steady growth, with investments in both the manufacturing of existing drugs and the development of new pharmaceutical products. The country’s commitment to research and development, coupled with its access to EU markets, makes it an attractive location for pharmaceutical companies.

Furniture and Wood Processing: A Long-Standing Tradition

Poland has a long-standing tradition in furniture manufacturing and wood processing, and this sector continues to attract significant investment. The country’s abundant forest resources and skilled craftsmanship contribute to its strength in this area.

High-Quality Furniture Production

Polish furniture manufacturers are renowned for their quality and design, catering to both domestic and international markets. The availability of raw materials and a dedicated workforce ensure the continued success of this sector.

Sustainable Forestry and Wood Product Manufacturing

A growing emphasis on sustainable practices in forestry and wood product manufacturing is further enhancing Poland’s appeal. Companies are investing in environmentally responsible sourcing and production methods, aligning with global trends towards sustainability.

Challenges and Opportunities: Navigating the Future of Manufacturing in Poland

While the trajectory of manufacturing in Poland appears overwhelmingly positive, it is crucial to acknowledge the inherent challenges and emerging opportunities that will shape its future.

Addressing Labor Shortages and Skill Gaps

As the manufacturing sector expands, the demand for skilled labor is projected to outpace supply in certain areas. Addressing potential labor shortages and investing in ongoing skill development will be crucial for sustained growth.

Investment in Vocational Training and Education

Continuous investment in vocational training programs, apprenticeships, and university curricula is essential to equip the workforce with the skills demanded by advanced manufacturing. This proactive approach acts as a bulwark against future labor market imbalances.

Attracting and Retaining Talent

Companies will need to focus on attractive compensation packages, career development opportunities, and fostering positive work environments to attract and retain skilled professionals. This is a long-term game of cultivating loyalty and expertise.

Infrastructure Development and Logistics Optimization

While Poland’s infrastructure is improving, continuous investment in transportation networks, energy supply, and digital connectivity will be vital to support the growing manufacturing output.

Expanding Transportation Networks

Further development of highways, railways, and intermodal transport facilities will enhance the efficiency of goods movement and reduce logistical costs. This is about building better arteries for the economic body.

Investing in Digital Infrastructure

Reliable and high-speed digital infrastructure is paramount for the adoption of Industry 4.0 technologies, smart manufacturing, and efficient data management. The digital backbone must be as robust as the physical infrastructure.

Maintaining Competitiveness Amidst Global Shifts

The global manufacturing landscape is constantly evolving, and Poland must remain adaptable to maintain its competitive edge. This involves fostering innovation, embracing technological advancements, and staying abreast of international market trends.

Fostering Innovation and R&D

Encouraging investment in research and development, fostering collaboration between industry and academia, and supporting technological innovation will be key to moving up the value chain and developing new products and processes. This is about sowing the seeds of future breakthroughs.

Embracing Sustainability and Green Manufacturing

As environmental concerns intensify, Polish manufacturers must prioritize sustainable practices, invest in green technologies, and adopt circular economy principles. This not only addresses regulatory requirements but also appeals to environmentally conscious consumers and investors. This is about future-proofing the industry for a greener tomorrow.

As the manufacturing landscape continues to shift, many companies are considering relocating their operations to Poland due to its favorable economic conditions and skilled workforce. This trend is highlighted in a recent article that explores the various factors driving this movement and the potential benefits for businesses. For more insights on this topic, you can read the full article here.

Conclusion: Poland as a Manufacturing Cornerstone

| Metric | Value | Notes |

|---|---|---|

| Annual Manufacturing Growth Rate | 4.5% | Average growth in manufacturing sector in Poland (2020-2023) |

| Average Labor Cost per Hour | 12.50 | Lower than Western Europe, attracting manufacturers |

| Number of New Manufacturing Plants (2023) | 150 | New facilities established by foreign companies |

| Top Manufacturing Sectors | Automotive, Electronics, Machinery | Key industries relocating or expanding in Poland |

| Average Time to Set Up Manufacturing Facility | 6 months | Includes permits, construction, and staffing |

| Export Volume Increase (2020-2023) | 20% | Growth in manufactured goods exported from Poland |

| Government Incentives | Up to 30% tax relief | For investments in Special Economic Zones |

| Logistics Advantage | Central European Location | Access to EU markets and efficient transport networks |

The migration of manufacturing to Poland is not a fleeting trend but a strategic realignment driven by a compelling blend of economic advantages, geopolitical stability, and a strong commitment to industrial development. Poland has demonstrably evolved from a cost-competitive manufacturing location to a sophisticated industrial hub, capable of supporting high-value production and technological innovation.

As global supply chains recalibrate and companies seek resilience and proximity to key markets, Poland stands as a beacon of opportunity. Its strategic location, skilled workforce, supportive business environment, and growing industrial ecosystem position it as a crucial cornerstone in the future of European manufacturing. Understanding the nuances of this manufacturing shift is essential for businesses looking to optimize their operations and navigate the evolving global economic landscape effectively.

WATCH THIS 🔴 SHOCKING: Why Germany’s Factory Exodus Is Permanent (Not Temporary)

FAQs

1. Why are companies moving their manufacturing operations to Poland?

Many companies are relocating manufacturing to Poland due to its strategic location in Europe, competitive labor costs, skilled workforce, and access to the European Union market. Poland also offers favorable business conditions and government incentives for foreign investors.

2. What industries are most commonly moving manufacturing to Poland?

Key industries moving manufacturing to Poland include automotive, electronics, machinery, and consumer goods. The country has a strong industrial base and supply chain infrastructure supporting these sectors.

3. How does Poland’s labor market benefit manufacturing companies?

Poland provides a large pool of well-educated and skilled workers, particularly in engineering and technical fields. Labor costs are generally lower than in Western Europe, making it cost-effective for manufacturing operations.

4. What infrastructure supports manufacturing in Poland?

Poland has a well-developed infrastructure including modern transport networks (roads, railways, and ports), industrial parks, and logistics centers. This facilitates efficient production and distribution within Europe and beyond.

5. Are there any challenges companies face when moving manufacturing to Poland?

Challenges can include navigating local regulations, language barriers, and adapting to cultural differences. Additionally, companies must consider supply chain integration and potential fluctuations in labor availability. However, many find these manageable with proper planning and local partnerships.