Geopolitical risk refers to the potential for political events or conditions in one country or region to impact the economic and financial stability of another. This risk can arise from a variety of factors, including military conflicts, diplomatic tensions, trade disputes, and changes in government policies. As nations become increasingly interconnected through trade and finance, the implications of geopolitical events can ripple across borders, affecting global markets and investor sentiment.

Understanding these dynamics is crucial for businesses and investors alike, as they navigate an ever-evolving landscape marked by uncertainty. The complexity of geopolitical risk is further compounded by the rapid pace of globalization and technological advancement. In today’s world, information travels at lightning speed, and events that occur in one part of the globe can have immediate repercussions elsewhere.

For instance, a political upheaval in a resource-rich country can lead to fluctuations in commodity prices, which in turn can affect economies thousands of miles away. As such, stakeholders must remain vigilant and informed about geopolitical developments to anticipate potential risks and opportunities.

Key Takeaways

- Geopolitical risks significantly influence the availability and cost of dollar funding in global markets.

- Identifying and understanding sources of geopolitical risk is crucial for anticipating dollar funding squeezes.

- Diversification and alternative funding sources are key strategies to mitigate the impact of geopolitical uncertainties.

- Case studies demonstrate effective approaches to managing dollar funding challenges amid geopolitical tensions.

- Building long-term resilience requires integrated strategies addressing both geopolitical risk and dollar funding dynamics.

Impact of Geopolitical Risk on Dollar Funding

The implications of geopolitical risk extend significantly into the realm of dollar funding, which is critical for international trade and investment. The U.S. dollar serves as the world’s primary reserve currency, and its dominance in global finance means that geopolitical tensions can lead to fluctuations in dollar liquidity.

When geopolitical risks escalate, investors often seek safe-haven assets, leading to increased demand for U.S. dollars. This heightened demand can create a tightening of dollar funding conditions, making it more challenging for businesses and governments to access the capital they need.

Moreover, geopolitical instability can lead to increased volatility in financial markets, which can further complicate dollar funding. For instance, if a country faces sanctions or political turmoil, its ability to engage in international transactions may be severely hampered. This situation can create a ripple effect, impacting not only the affected nation but also its trading partners and investors who rely on dollar-denominated transactions.

As a result, understanding the interplay between geopolitical risk and dollar funding is essential for stakeholders aiming to navigate these turbulent waters effectively.

Identifying Sources of Geopolitical Risk

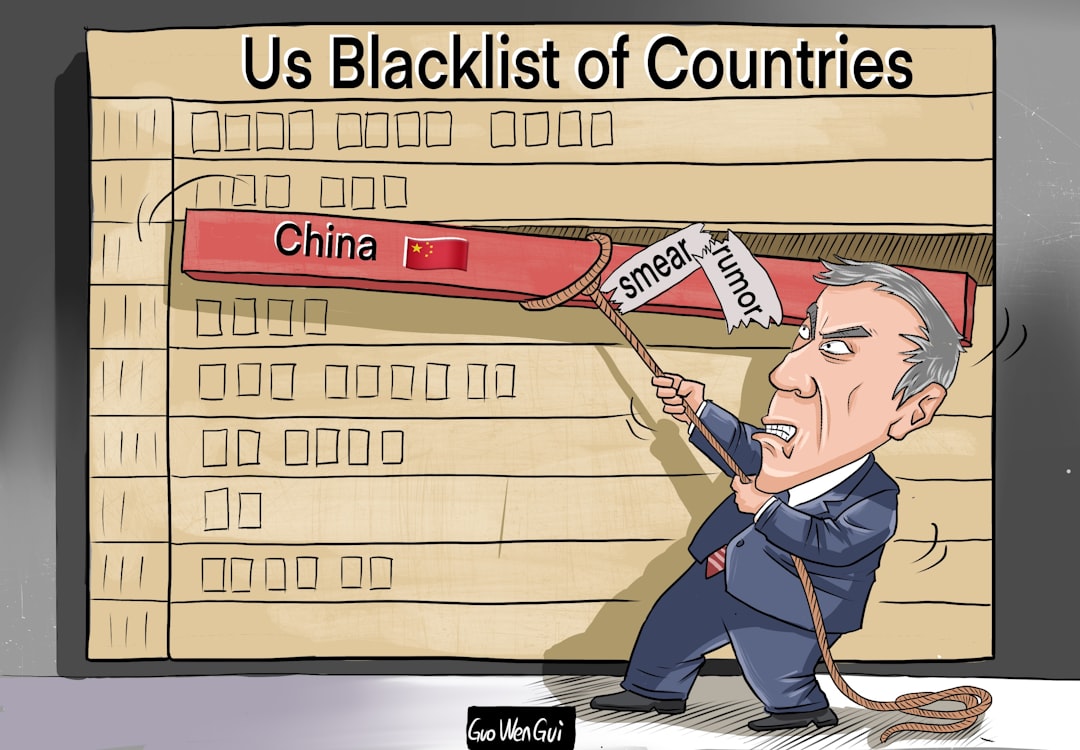

Identifying sources of geopolitical risk requires a multifaceted approach that considers various factors influencing global stability. One significant source is military conflict, which can arise from territorial disputes, ideological differences, or competition for resources. Such conflicts often lead to economic sanctions, trade disruptions, and shifts in investor sentiment, all of which can have far-reaching consequences for dollar funding and international markets.

Another critical source of geopolitical risk stems from economic policies and trade relations between nations. Trade wars, tariffs, and protectionist measures can create friction between countries, leading to uncertainty in global supply chains and financial markets. Additionally, changes in government leadership or policy direction can introduce unpredictability into the economic landscape, further complicating the assessment of geopolitical risk.

Stakeholders must remain attuned to these developments to effectively gauge potential threats to their operations and investments.

Strategies for Mitigating Geopolitical Risk

| Strategy | Description | Key Metrics | Effectiveness | Implementation Complexity |

|---|---|---|---|---|

| Diversification of Supply Chains | Reducing dependency on a single country or region by sourcing from multiple locations. | Number of suppliers, Geographic spread, Supply chain lead time | High | Medium |

| Political Risk Insurance | Insurance policies that protect against losses from political events such as expropriation or civil unrest. | Coverage amount, Premium cost, Claim settlement time | Medium | Low |

| Local Partnerships and Joint Ventures | Collaborating with local firms to gain market insights and reduce exposure to political risks. | Number of partnerships, Local market share, Regulatory compliance rate | Medium | High |

| Scenario Planning and Stress Testing | Analyzing potential geopolitical scenarios and their impact on business operations. | Number of scenarios tested, Risk exposure reduction, Response time | High | High |

| Engagement with Government and Diplomacy | Building relationships with government officials and participating in diplomatic efforts. | Number of government contacts, Frequency of engagement, Policy influence | Medium | Medium |

| Investment in Cybersecurity | Protecting digital assets from cyber threats that may be politically motivated. | Number of cyber incidents, Response time, Security audit scores | High | Medium |

To mitigate geopolitical risk, organizations must adopt proactive strategies that encompass both risk assessment and management. One effective approach is to conduct thorough geopolitical risk assessments that analyze potential threats based on current events and historical trends. By understanding the specific risks associated with different regions or countries, businesses can make informed decisions about where to invest or operate.

Another strategy involves diversifying operations and supply chains across multiple regions. By spreading exposure across various markets, organizations can reduce their vulnerability to localized geopolitical events. This diversification not only helps mitigate risks but also allows companies to capitalize on opportunities that may arise in more stable regions.

Additionally, maintaining strong relationships with local stakeholders can provide valuable insights into emerging risks and help organizations navigate complex political landscapes.

Dollar Funding Squeeze: Causes and Consequences

A dollar funding squeeze occurs when there is a sudden tightening of liquidity in the U.S. dollar market, making it difficult for borrowers to access funds denominated in dollars. Several factors can contribute to this phenomenon, including heightened geopolitical tensions that lead investors to seek safe-haven assets.

When uncertainty prevails, financial institutions may become more cautious in their lending practices, resulting in reduced availability of dollar funding. The consequences of a dollar funding squeeze can be severe for businesses and governments alike. Companies that rely on dollar-denominated debt may face increased borrowing costs or even find themselves unable to refinance existing obligations.

This situation can lead to liquidity crises, forcing organizations to cut back on investments or operational expenditures. For governments, a funding squeeze can hinder their ability to finance public services or respond effectively to economic challenges, ultimately impacting overall economic stability.

The Role of Geopolitical Risk in Dollar Funding Squeeze

Geopolitical risk plays a pivotal role in shaping the dynamics of dollar funding squeezes. When tensions escalate between nations—whether due to military conflicts or trade disputes—investors often react by reallocating their portfolios toward safer assets, such as U.S. Treasury bonds. This flight to safety can create an imbalance in the demand for dollars versus the supply available in the market. As demand for dollars increases amid geopolitical uncertainty, financial institutions may tighten their lending standards or raise interest rates on dollar-denominated loans. This tightening can exacerbate existing funding challenges for businesses operating in affected regions or industries. Furthermore, as countries grapple with the fallout from geopolitical events, they may implement capital controls or other measures that restrict access to dollar funding, further complicating the financial landscape.

Navigating Dollar Funding Squeeze in Geopolitically Risky Environments

Navigating a dollar funding squeeze in geopolitically risky environments requires a strategic approach that prioritizes flexibility and adaptability. Organizations must be prepared to respond quickly to changing market conditions by maintaining robust liquidity management practices.

Additionally, fostering strong relationships with financial institutions can provide organizations with valuable insights into market conditions and potential funding opportunities. By engaging with banks and lenders proactively, businesses can position themselves favorably when seeking financing during periods of heightened geopolitical risk. Moreover, leveraging technology and data analytics can enhance decision-making processes by providing real-time information on market trends and potential risks.

Leveraging Alternative Funding Sources in Geopolitically Risky Situations

In times of geopolitical uncertainty, organizations may need to explore alternative funding sources beyond traditional bank loans or capital markets. One viable option is tapping into private equity or venture capital firms that specialize in providing financing during challenging economic conditions. These investors often have a higher risk tolerance and may be more willing to support businesses facing funding challenges due to geopolitical events.

Another alternative is considering partnerships or joint ventures with local firms that possess a deeper understanding of the regional landscape. Such collaborations can not only provide access to additional capital but also enhance operational resilience by leveraging local expertise and networks. Furthermore, exploring crowdfunding platforms or peer-to-peer lending options can offer innovative ways to secure financing while diversifying funding sources.

The Importance of Diversification in Managing Geopolitical Risk and Dollar Funding

Diversification emerges as a critical strategy for managing both geopolitical risk and dollar funding challenges effectively. By spreading investments across various geographic regions and asset classes, organizations can reduce their exposure to localized risks that may arise from political instability or economic downturns. This approach not only mitigates potential losses but also positions businesses to capitalize on growth opportunities in more stable markets.

In addition to geographic diversification, organizations should consider diversifying their funding sources as well. Relying solely on traditional bank financing can leave businesses vulnerable during periods of market volatility or geopolitical tension. By exploring alternative funding avenues—such as bonds, equity financing, or international partnerships—organizations can enhance their financial resilience and ensure they have access to capital when needed most.

Case Studies: Successful Navigation of Geopolitical Risk and Dollar Funding Squeeze

Examining case studies of organizations that have successfully navigated geopolitical risk and dollar funding squeezes provides valuable insights into effective strategies. One notable example is a multinational corporation that faced significant challenges during a regional conflict that disrupted supply chains and created uncertainty in financial markets. By diversifying its operations across multiple countries and establishing strong relationships with local partners, the company was able to mitigate risks and maintain access to critical resources.

Another case involves a technology startup that encountered difficulties securing dollar funding amid rising geopolitical tensions between its home country and key trading partners. By leveraging alternative funding sources such as venture capital firms with an appetite for high-risk investments, the startup successfully secured the necessary capital to continue its operations and expand into new markets despite the challenging environment.

Building Resilience: Long-term Strategies for Managing Geopolitical Risk and Dollar Funding

Building resilience against geopolitical risk and dollar funding challenges requires a long-term commitment to strategic planning and proactive risk management. Organizations should prioritize continuous monitoring of geopolitical developments and market trends to stay ahead of potential threats.

Furthermore, fostering a culture of adaptability within organizations is essential for navigating uncertainty effectively. Encouraging innovation and flexibility among teams allows businesses to respond swiftly to changing circumstances while maintaining operational continuity. By integrating these long-term strategies into their core operations, organizations can enhance their resilience against geopolitical risks and ensure sustainable access to dollar funding even in turbulent times.

Geopolitical risks have significant implications for global financial markets, particularly in the context of a dollar funding squeeze. For a deeper understanding of how these dynamics interact, you can explore the article on this topic at this link. The article delves into the challenges faced by countries reliant on dollar funding amidst rising geopolitical tensions, highlighting the potential consequences for international trade and investment.

WATCH THIS! The Bank That Will Break The World: Why The Secret Collapse Is Already Underway

FAQs

What is geopolitical risk?

Geopolitical risk refers to the potential for political events, conflicts, or instability in different regions or countries to impact global economic and financial markets. These risks can arise from wars, political upheavals, sanctions, or diplomatic tensions.

How does geopolitical risk affect financial markets?

Geopolitical risk can lead to increased market volatility, changes in investor sentiment, disruptions in trade, and shifts in currency values. It often causes investors to seek safer assets, which can impact liquidity and funding conditions in global markets.

What is a dollar funding squeeze?

A dollar funding squeeze occurs when there is a shortage of US dollar liquidity in the global financial system. This can make it more difficult and expensive for banks and companies outside the US to obtain dollar funding, which is essential for international trade and finance.

Why is the US dollar important in global funding?

The US dollar is the world’s primary reserve currency and is widely used in international trade, finance, and as a benchmark currency. Many global transactions and debt obligations are denominated in dollars, making access to dollar funding critical for global financial stability.

How can geopolitical risk lead to a dollar funding squeeze?

Geopolitical tensions can disrupt financial markets and reduce the willingness of banks and investors to lend dollars. This can tighten dollar liquidity, increase borrowing costs, and create a funding squeeze, especially for institutions reliant on dollar-denominated funding.

What are the consequences of a dollar funding squeeze?

A dollar funding squeeze can lead to higher borrowing costs, reduced credit availability, and increased financial stress for companies and banks globally. It can also exacerbate market volatility and potentially slow down global economic growth.

How do central banks respond to a dollar funding squeeze?

Central banks, including the US Federal Reserve, may intervene by providing dollar liquidity through swap lines or other monetary policy tools to ease funding pressures and stabilize markets.

Can geopolitical risk and dollar funding squeezes impact emerging markets?

Yes, emerging markets are often more vulnerable to dollar funding squeezes because they rely heavily on dollar-denominated debt. Geopolitical risks can exacerbate these pressures, leading to capital outflows, currency depreciation, and financial instability in these countries.

What measures can institutions take to mitigate risks from geopolitical tensions and dollar funding squeezes?

Institutions can diversify their funding sources, maintain adequate liquidity buffers, hedge currency risks, and monitor geopolitical developments closely to manage potential impacts on their operations and financing costs.