The global demand for rare earth magnets, essential components in everything from electric vehicles and wind turbines to smartphones and medical devices, is undergoing a significant surge. This escalating need, coupled with the complex and geographically concentrated nature of their production, has brought the security and resilience of the rare earth magnet supply chain into sharp focus. Understanding the intricacies of this supply chain and the strategies being employed to fortify it is critical for industries dependent on these powerful magnetic materials and for nations aiming to maintain technological leadership and economic stability.

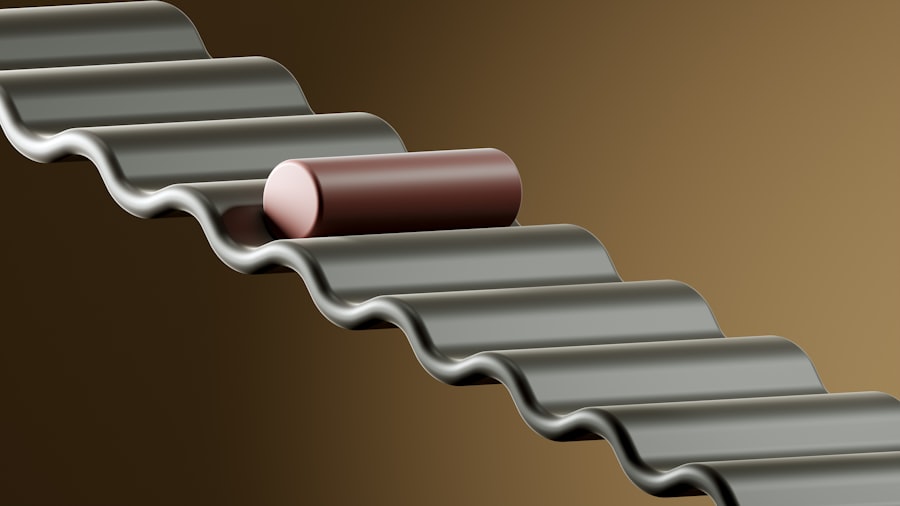

Rare earth elements are a group of 17 chemically similar metallic elements, including neodymium, praseodymium, dysprosium, and terbium, which are crucial for producing high-performance permanent magnets. These magnets, particularly those made from neodymium-iron-boron (NdFeB), boast magnetic strengths far exceeding those of traditional ferrite or alnico magnets. This exceptional performance allows for smaller, lighter, and more efficient designs in a vast array of applications.

What are Rare Earth Elements?

The Magnetic Powerhouse: Neodymium and Beyond

Applications Driving Demand

The automotive industry is a primary driver, with electric vehicles (EVs) relying heavily on rare earth magnets for their electric motors. As the global transition towards EVs accelerates, so does the demand for the magnets that power them. Similarly, the renewable energy sector, particularly wind turbines, utilizes large and powerful rare earth magnets to generate electricity efficiently. Beyond these high-volume applications, smaller yet significant uses exist in consumer electronics, defense systems, and advanced medical technologies, all contributing to an ever-increasing appetite for these critical minerals.

The complexities of the rare earth magnet supply chain have garnered significant attention in recent years, particularly due to the increasing demand for these critical materials in various high-tech applications. For a deeper understanding of the challenges and developments in this sector, you can read a related article that explores the geopolitical implications and market dynamics surrounding rare earth elements. For more information, visit this article.

The Geopolitical Chessboard: Concentration and Vulnerability

The supply chain for rare earth magnets is not a sprawling, diversified network. Instead, it is characterized by a significant concentration of extraction and processing capabilities in a limited number of countries. This concentration, a consequence of historical resource discoveries, economic factors, and established industrial infrastructure, presents inherent geopolitical vulnerabilities. Any disruption to this delicate balance, whether due to political instability, trade disputes, or regulatory changes, can have ripple effects across global industries.

The Dominance of China

Barriers to Entry for New Producers

Establishing a new rare earth mine and processing facility is a capital-intensive and time-consuming endeavor. The geological surveys, environmental impact assessments, permitting processes, and the construction of complex refining and manufacturing infrastructure require substantial investment and expertise. Furthermore, the existing economies of scale in established producing nations create a competitive hurdle for new entrants. This creates a scenario where a handful of players hold significant sway over global supply.

The Impact of Resource Nationalism

Some nations, recognizing the strategic importance of rare earth elements, have implemented policies to control their exploration, extraction, and export. These policies, often termed “resource nationalism,” can manifest as export quotas, increased taxation, or outright restrictions on foreign ownership of mining operations. While intended to secure domestic benefits, such measures can introduce uncertainty and volatility into the global market, impacting the predictability of supply for downstream manufacturers.

Fortifying the Chain: Diversification and Innovation

Addressing the vulnerabilities inherent in the current rare earth magnet supply chain requires a multi-pronged approach. Strategies are being deployed to diversify sources of supply, encourage domestic production, and accelerate the development of alternative technologies. This is not a simple matter of finding new mines; it involves a complex interplay of economic, technological, and diplomatic efforts.

Expanding Geographic Sourcing

Efforts are underway to identify and develop new mining and processing operations outside of the established hubs. Countries like Australia, the United States, Canada, and several European nations are actively exploring their rare earth reserves and investing in processing capabilities. The goal is to reduce reliance on any single source and create a more distributed and resilient supply network. This is akin to building more harbors on a coast instead of relying on a single, vulnerable port.

Investing in Domestic Processing

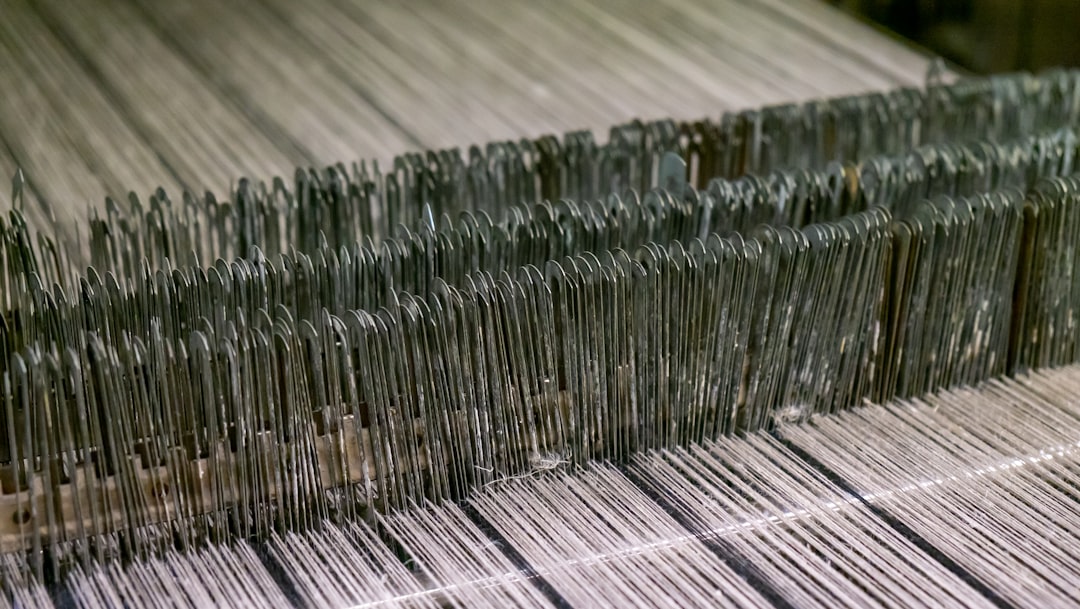

Even where rare earth minerals are mined domestically, the processing and magnet manufacturing stages have often been concentrated elsewhere. Significant investments are being made to build and expand these downstream capabilities within countries seeking greater supply chain autonomy. This involves not only building new facilities but also developing the skilled workforce and technological expertise required for these complex processes.

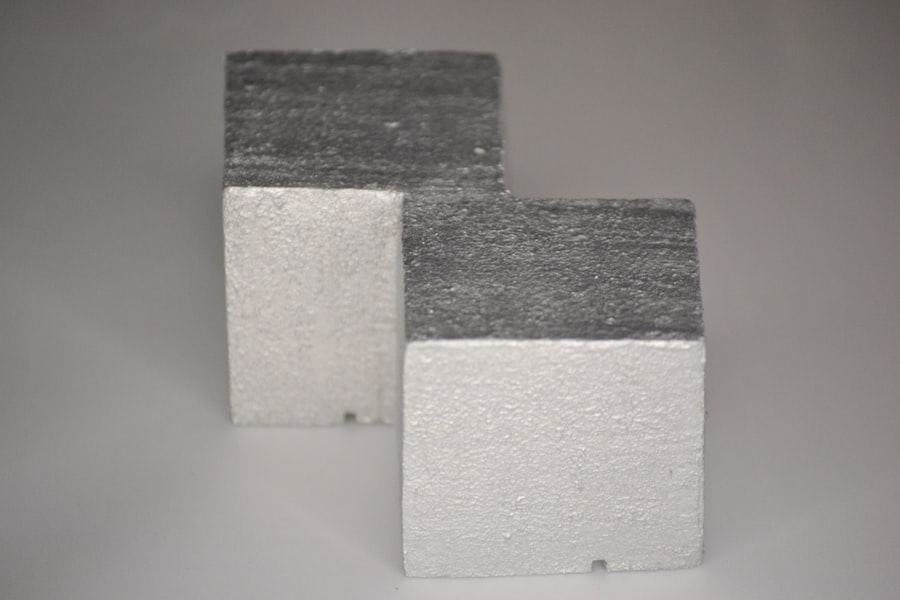

Exploring Alternative Magnet Technologies

While rare earth magnets offer unparalleled performance, research and development are also focused on alternative magnetic materials that utilize less or no rare earth elements. This includes advancements in ferrite magnets, alnico magnets, and novel composite materials. The aim is to create a parallel technological pathway that can serve as a fallback or complementary solution, reducing overall demand for rare earths.

The Circular Economy: Recycling and Recovery

A critical, yet often overlooked, component of securing the rare earth magnet supply chain is the development of effective recycling and recovery processes. These powerful magnets are embedded in a vast array of discarded electronics and industrial equipment. Harnessing these existing sources can significantly reduce the need for virgin extraction.

The Potential of End-of-Life Products

As the lifespan of many high-tech devices shortens and the installed base of EVs and wind turbines grows, the volume of rare earth-containing waste will only increase. This presents a substantial opportunity for material recovery. Current recycling rates, however, are often low, and the processes are complex and costly.

Technological Challenges in Rare Earth Recycling

Extracting rare earth elements from complex mixed-metal products is a significant technical hurdle. The diverse matrices in which these elements are found, often in small quantities, require sophisticated chemical and physical separation techniques. Developing cost-effective and environmentally sound recycling methods is a key area of innovation.

Policy and Economic Incentives for Recycling

To drive the adoption of rare earth recycling, supportive policies and economic incentives are crucial. This can include extended producer responsibility schemes, landfill taxes on rare earth-containing waste, and subsidies for recycling infrastructure. Creating a market for recycled rare earths, driven by both environmental concerns and supply chain security, will be a vital factor in its success.

The complexities of the rare earth magnet supply chain have garnered significant attention in recent years, especially as global demand for these essential materials continues to rise. A related article that delves into the intricacies of this supply chain can be found at Real Lore and Order, where it explores the geopolitical factors and environmental considerations that influence the production and distribution of rare earth elements. Understanding these dynamics is crucial for industries reliant on these magnets, from electronics to renewable energy technologies.

The Future Landscape: Collaboration and Strategic Management

| Metric | Description | Current Status | Challenges | Key Regions |

|---|---|---|---|---|

| Global Production Volume | Annual output of rare earth magnets (in metric tons) | Approx. 150,000 metric tons | Limited mining capacity, environmental regulations | China, USA, Japan, Europe |

| Primary Rare Earth Elements Used | Elements critical for magnet manufacturing | Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy), Terbium (Tb) | Supply risk due to geopolitical factors | China (dominant supplier), Australia, USA |

| Supply Chain Lead Time | Time from raw material extraction to magnet delivery | 6-12 months | Processing bottlenecks, export restrictions | Global |

| Recycling Rate | Percentage of rare earth magnets recycled from end-of-life products | Less than 1% | Technical difficulty in magnet recovery | Europe, Japan (pilot programs) |

| Price Volatility | Fluctuation in rare earth element prices over the last 5 years | High (up to 50% variation) | Trade tensions, export quotas | Global markets |

| Environmental Impact | Impact of mining and processing on environment | Significant (toxic waste, habitat disruption) | Strict regulations, need for sustainable practices | China, Australia, USA |

Securing the rare earth magnet supply chain is not merely a matter of industrial production; it is a strategic imperative that requires international cooperation, forward-thinking policy, and continuous adaptation. The landscape is dynamic, with technological advancements and geopolitical shifts constantly reshaping the challenges and opportunities.

International Collaboration and Partnerships

Addressing the global nature of this supply chain necessitates international collaboration. This can involve joint ventures in mining and processing, shared research and development efforts, and the establishment of common standards and best practices for extraction, processing, and recycling. Building trust and transparency among nations will be crucial for fostering a stable and reliable supply.

Government Policies and Strategic Stockpiling

Governments play a pivotal role in shaping the rare earth magnet supply chain through supportive policies. These can include direct investment in research and development, grants for domestic manufacturing, preferential procurement policies for materials sourced from diversified or recycled sources, and strategic stockpiling of critical rare earth elements and magnets. This proactive management of resources can act as a buffer against future disruptions.

The Role of Technological Forecasting and Adaptability

The technological landscape is constantly evolving. Industries reliant on rare earth magnets must engage in continuous technological forecasting to anticipate future demand shifts and the emergence of new applications. Simultaneously, a commitment to adaptability is essential, allowing for the swift integration of new materials, processes, and recycling methods as they become available. This proactive approach ensures that the supply chain remains agile and responsive to the ever-changing needs of modern technology. The journey to a secure rare earth magnet supply chain is a marathon, not a sprint, requiring sustained effort and a clear vision for the future.

FAQs

What are rare earth magnets and why are they important?

Rare earth magnets are strong permanent magnets made from alloys of rare earth elements such as neodymium, samarium, and dysprosium. They are essential in various high-tech applications including electronics, electric vehicles, wind turbines, and medical devices due to their superior magnetic strength and durability.

What are the main challenges in the rare earth magnet supply chain?

The main challenges include limited geographic sources of rare earth elements, geopolitical risks, environmental concerns related to mining and processing, supply-demand imbalances, and the complexity of refining and manufacturing processes. These factors can lead to supply disruptions and price volatility.

Which countries dominate the rare earth magnet supply chain?

China is the dominant player in the rare earth magnet supply chain, controlling a significant portion of rare earth mining, processing, and magnet manufacturing. Other countries involved include the United States, Australia, and some Southeast Asian nations, but their production capacity is comparatively smaller.

How does the supply chain impact the cost of rare earth magnets?

The supply chain impacts cost through raw material availability, processing complexity, transportation logistics, and geopolitical factors. Disruptions or restrictions in mining or export can lead to increased prices. Additionally, environmental regulations and technological advancements also influence production costs.

What measures are being taken to secure the rare earth magnet supply chain?

Efforts include diversifying supply sources, investing in recycling and alternative materials, developing domestic mining and processing capabilities, enhancing international cooperation, and improving supply chain transparency. Governments and industries are also focusing on sustainable and environmentally friendly extraction methods.